Supply And Demand Levels In Forex

Supply and Demand Levels and Price Activeness Trading

@Colibritrader

Supply and demand levels are commonly associated with back up and resistance levels.

I must say that they share a lot of mutual characteristics, but are even so slightly different structurally.

In this commodity I volition explore some of the characteristics that supply and demand levels exhibit and how they chronicle to price activeness trading.

As you a lot of you might be familiar, I recently launched a Supply and Demand trading form that shows how I trade with supply and demand zones.

In this article, I will share why supply and demand and cost activeness are intertwined.

Allow me starting time start with the definition of supply and demand levels.

Supply and Demand Levels

Supply and demand levels are very shut to back up and resistance levels.

The majority of you are possibly familiar with support and resistance and this means that you lot are prepare to have your trading to the side by side level.

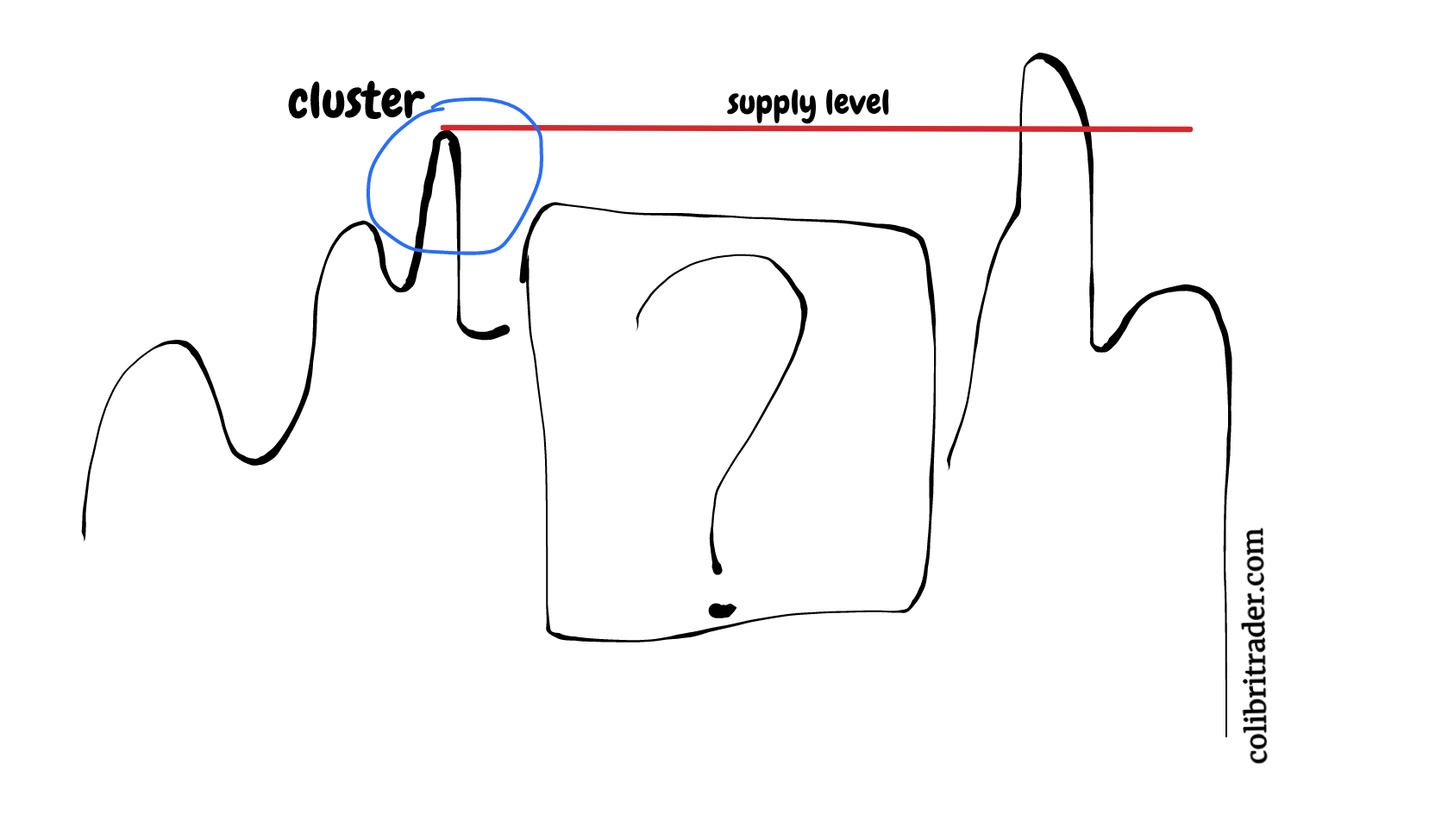

Supply level

What is a supply level?

It is a place on the chart that is marked by a either:

- Stiff bullish candle that precedes it or stiff bearish candle follows this level

- Cluster of a few minor-bodied candles

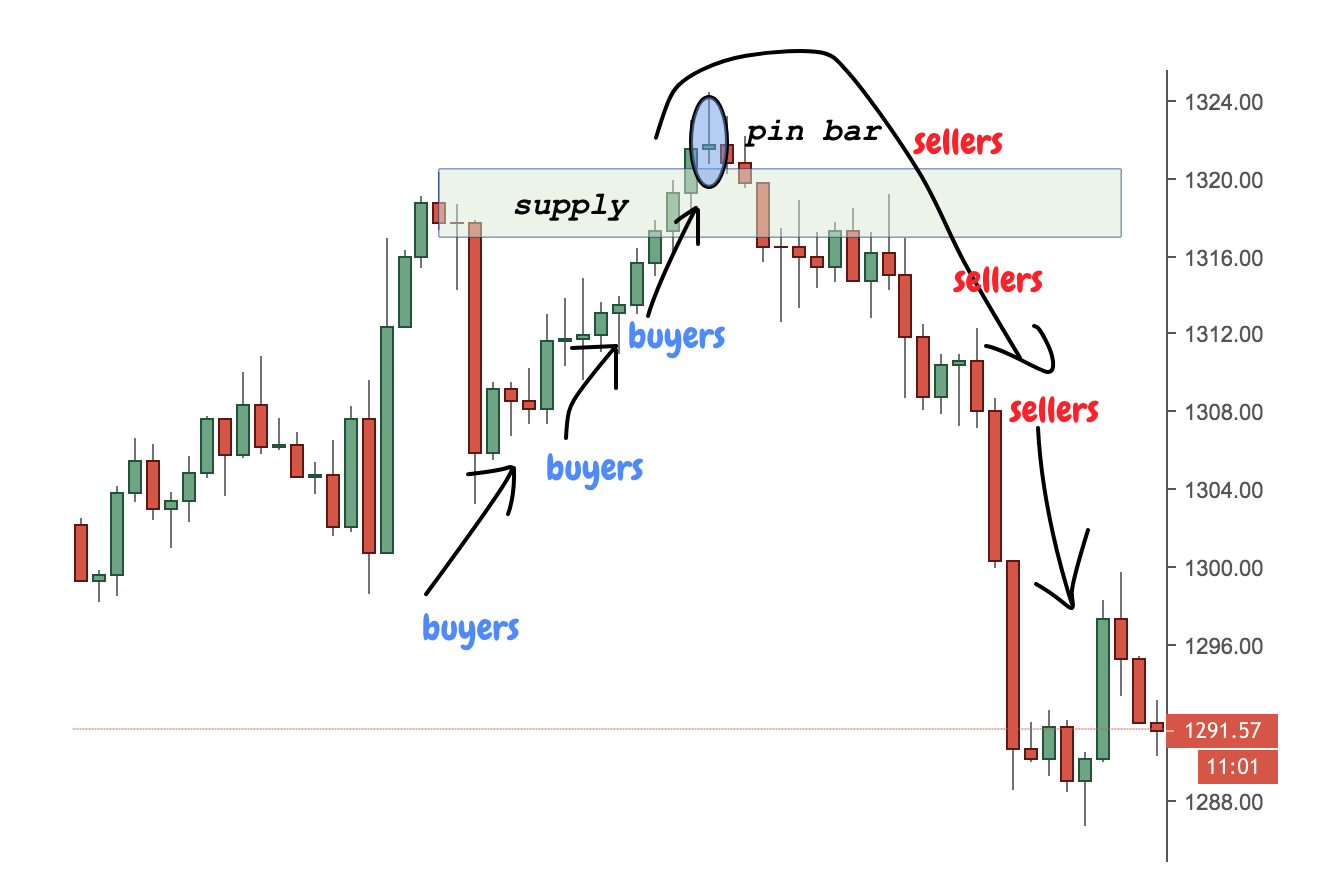

Hither is a chart that illustrates that principle in real fourth dimension:

I am usually taking the highest indicate in the region every bit shown higher up. Supply levels are nada else, but a very powerful resistance level for which supply and demand traders are aiming to brusque.

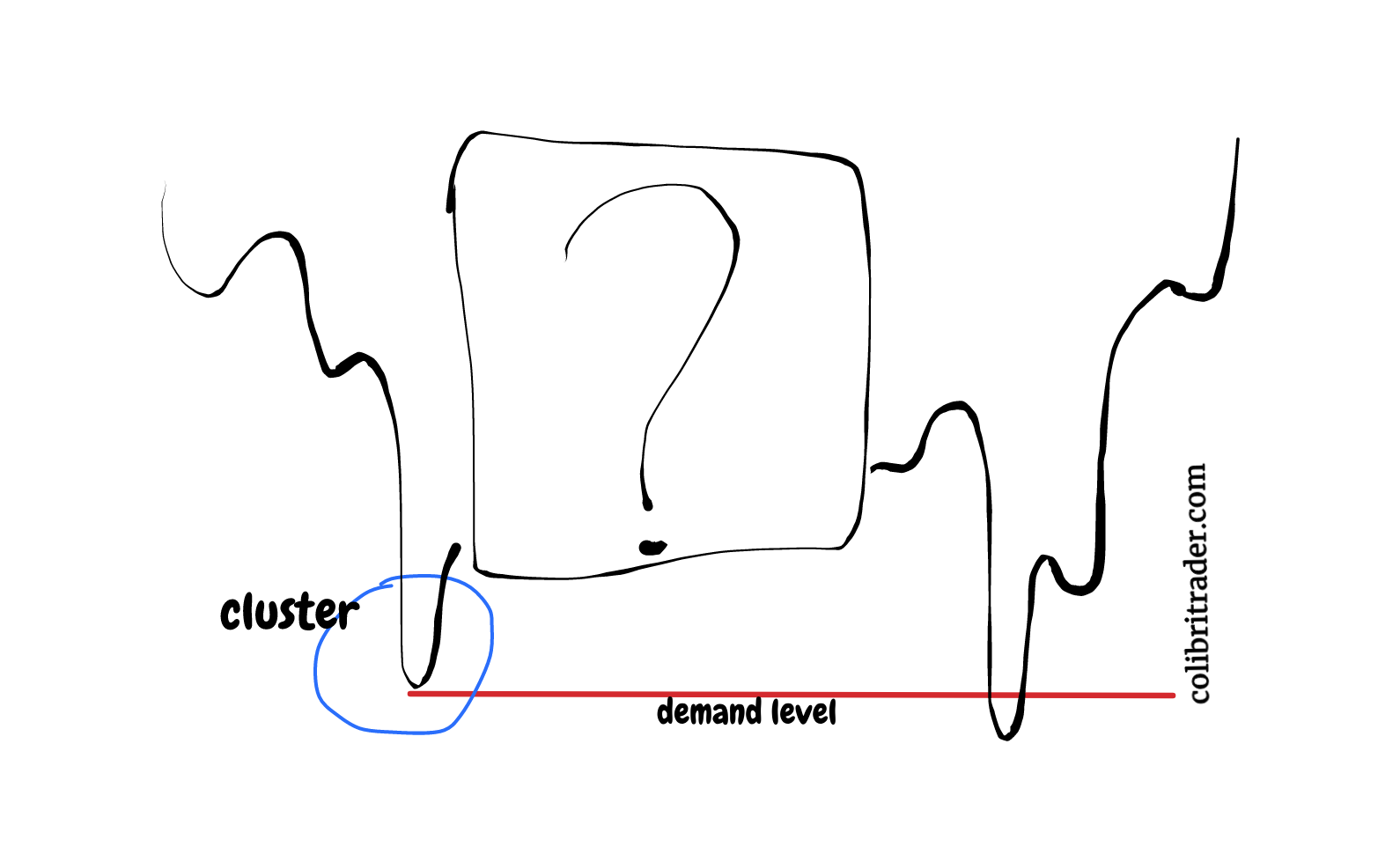

Need Level

Demand levels are just the opposite of what a supply level is.

In social club to qualify for a demand level, you will need to tick either one of those two boxes:

- Sharp bearish candle that precedes that level or a strong bullish candle that follows it

- A cluster of pocket-size-bodied candles that forms around it

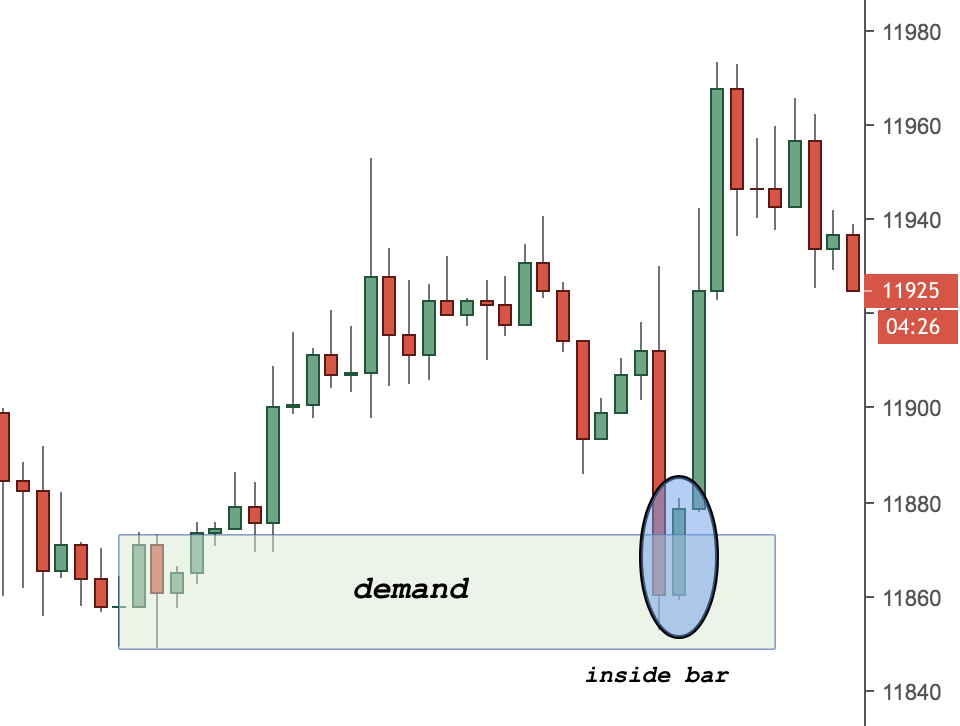

Hither is a real life instance of a demand level:

I am normally taking the lowest point in the area as shown above in order to marking the area.

Those levels are quite rare and when they occur, they are really powerful sign for supply and need traders.

Support and Resistance Levels

What are support and resistance levels and are they much different than supply and need levels?

Non really!

To exist honest, they are pretty much the same level. The only difference between resistance and supply and demand and back up is the price action around those levels equally explained above.

Other than that they have the verbal aforementioned characteristics and are indeed both quite powerful tools for the price action trader.

Support

Just to reiterate, a back up level is the level at which demand is potent plenty so that toll does non go lower.

The logic backside that is that as the toll goes lower, it becomes cheaper and more alluring for market participants to buy.

By the time that cost is at the back up, supply will overcome need and the cost volition bounce upwards and go higher.

Resistance

Resistance is the opposite of support. Information technology is the level at which sellers are hesitant to continue buying, because it is too expensive already.

The logic behind says that as buyers become more hesitant to purchase, sellers come into play and button the cost lower.

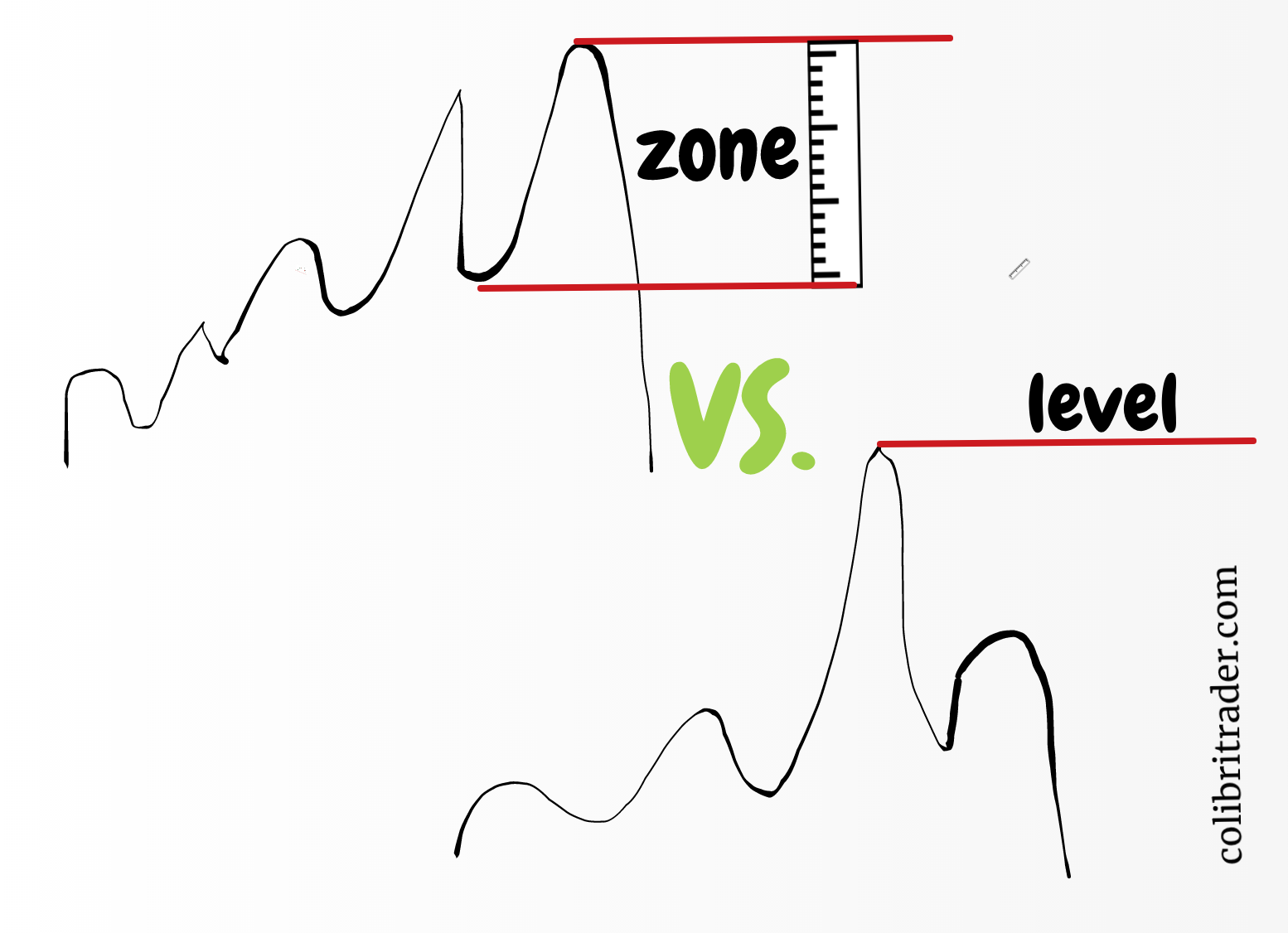

Zones vs. Levels

And then how much difference are supply and demand zones from supply and demand levels.

They are quite different.

The major difference is in the area they cover. The way traders use them is like.

Supply and demand levels require smaller amount to be risked, since a supply or demand level takes less space.

On the other side a supply or demand zone takes more than space and therefore requires slightly different coin management practices.

I have explained thoroughly in my trading course about supply and need trading how to minimise the take a chance when trading with supply and demand zones.

Permit'due south have a look at a couple of examples of zones vs. levels.

Supply Zone vs. Supply Level

Before I proceed, delight take a look at the image below:

Supply zone is by definition an area of potent resistance. Information technology encompasses a larger area than a supply level.

Supply level on the other side is a sparse line that marks the highest point in a region. It shares well-nigh the same characteristics with resistance.

For supply and demand traders it is harder to identify a trade in a supply zone. Psychologically they find it hard to observe a skillful place to place their end loss.

Whereas, for a supply level, it is unremarkably easier to notice a place where to place a cease loss guild.

From my perspective, a supply zone is more effective than a supply level. Since trading is not precise science, I have found supply zones to show traders amend where the majority of the large market participants are located.

A supply level could be a very stiff level of resistance, especially on weekly or monthly charts.

On anything below a daily nautical chart, commonly supply zones can help traders better if used correctly.

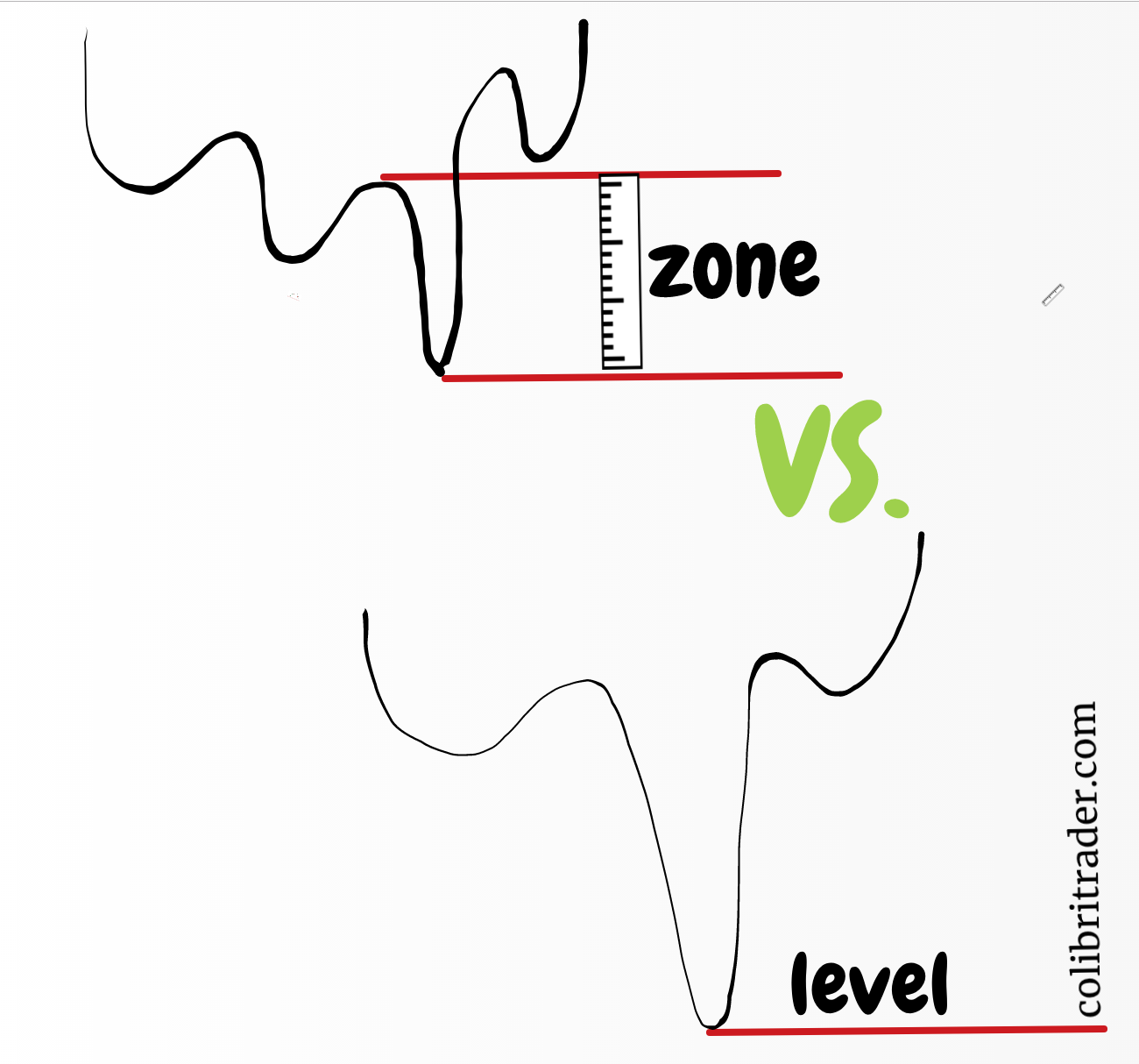

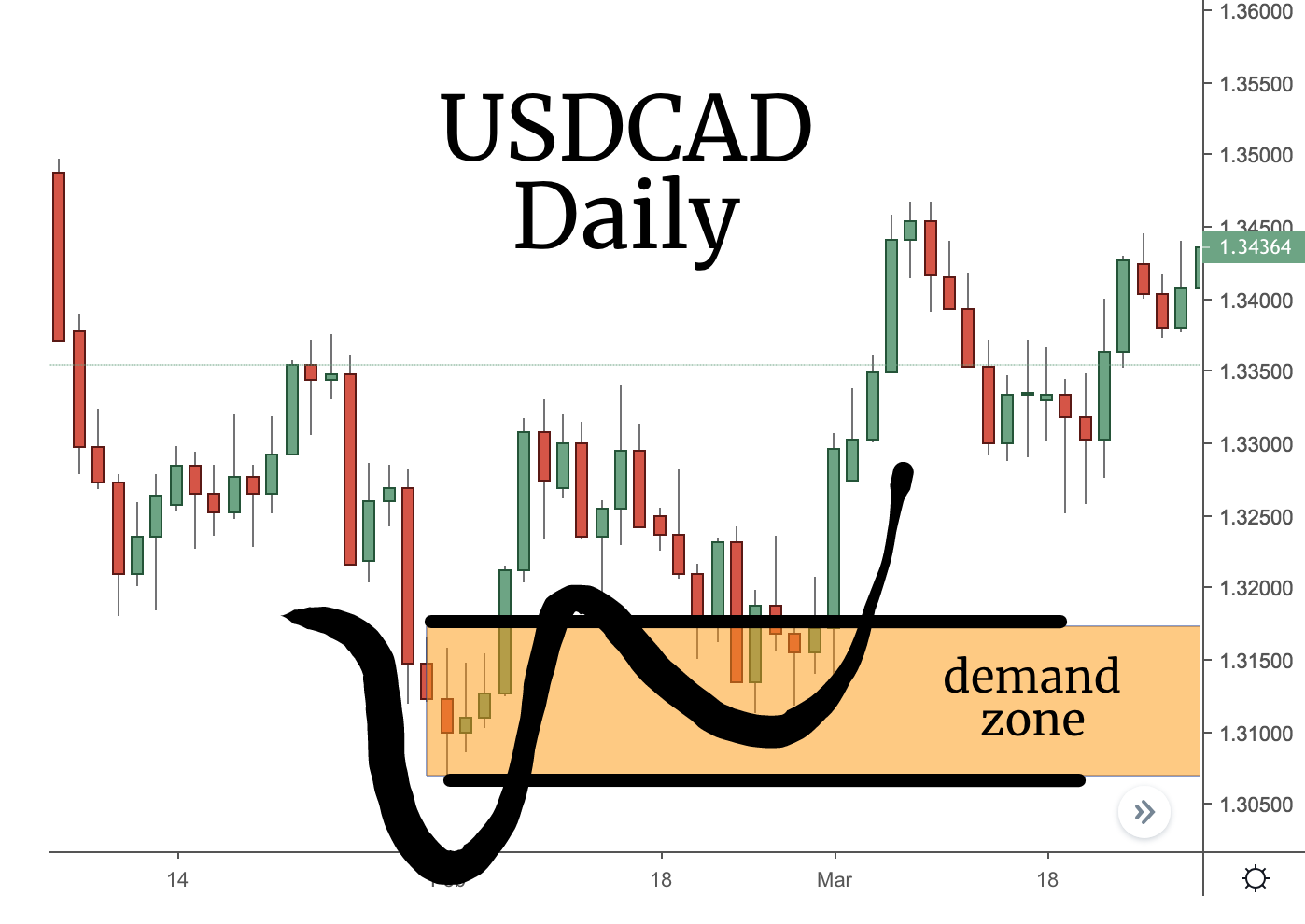

Need Zone vs. Demand Level

Permit's repeat the exercise from to a higher place and look at the image below:

Aforementioned as levels/zones of supply, a need zone encompasses a larger expanse than a demand level.

Very similar to supply zones, demand zones are amend used on timeframes below daily. Demand levels are near hands discernible on weekly and monthly charts.

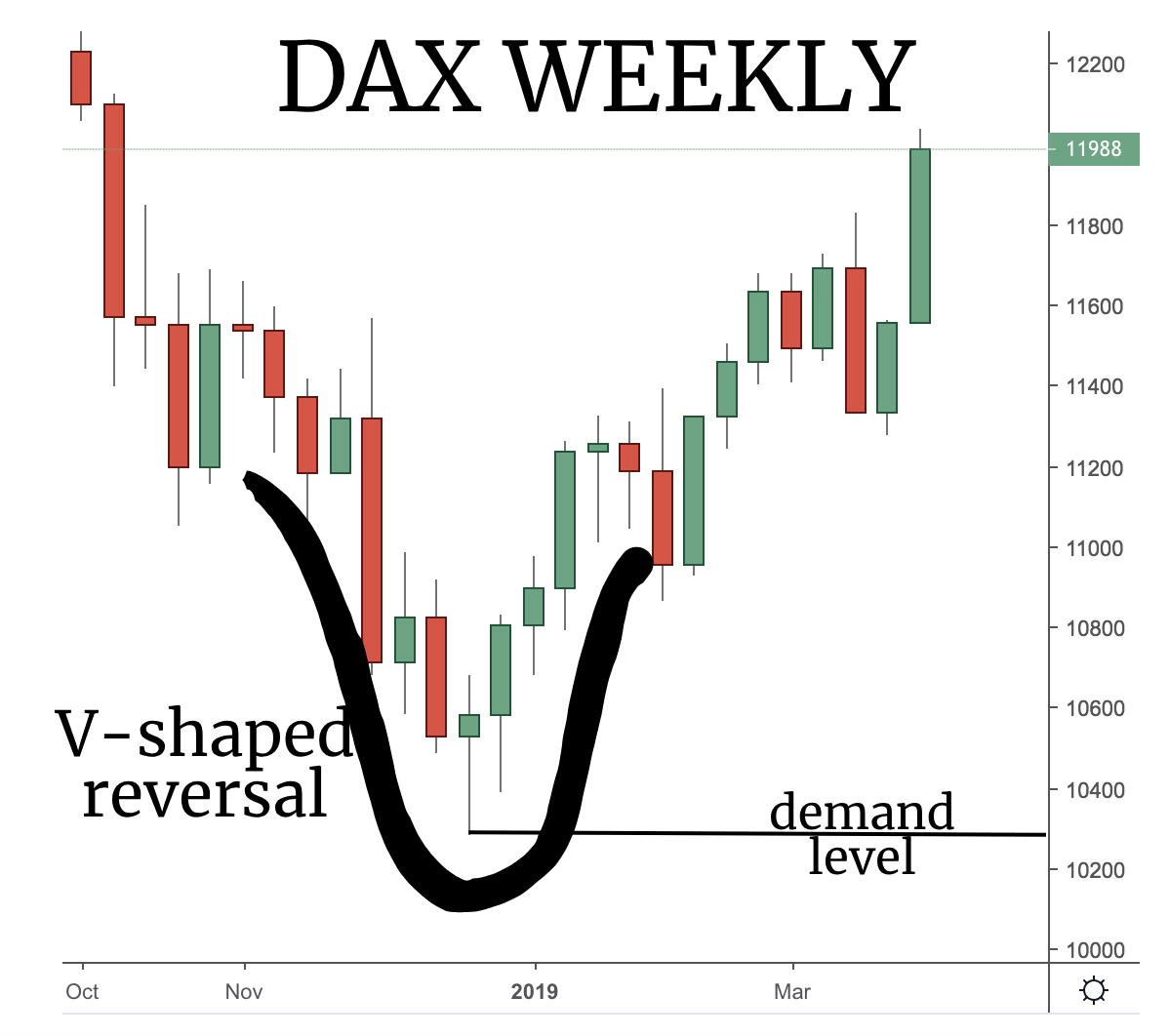

A demand level is a thin line that extends from the highest betoken in a sure region. As it was shown in the prototype higher up, ordinarily a demand level stands on the bottom of a sharp 5-shaped reversal pattern.

A real life scenario from the weekly chart of DAX is shown below:

On the other side, here is a real-life need zone example from the daily nautical chart of USDCAD:

Zones or Levels??

Equally you lot can meet from both images above, both demand levels and zones share the same meaning- they are both used as a place of powerful support.

The but departure is that one (zone) takes much larger space on the nautical chart than the other (line).

Supply and demand traders apply different approaches to this trading model, just in the finish they share the aforementioned market construction.

With practice you lot will come up to realise that finding them on the chart is easier than it initially looks. With the right trading strategy and methodology you will be half-way in that location.

Round Levels and Supply and Demand

As with any other indicator or trading tool, supply and need levels work great around round numbers.

This is generally due to the mass psychology of market place participants.

People just think in round numbers.

Simply think near it for a moment. When you go to the shop to buy something that costs yous 24.95 USD, y'all are thinking subconsciously thinking almost 25 USD (although marketers will attempt to convince me otherwise).

Our brains tend to simplify long numbers and shorten them to an easier chunk of data.

Aforementioned with market place prices.

We don't naturally call back in decimals. Therefore, when yous are buying or selling you are more than prone to think of a circular number (all other things being equal).

That is too the major reason why supply and demand lines work better effectually round numbers. They are not some sort of magical numbers, but just levels at which more people are willing to place a buy/sell lodge.

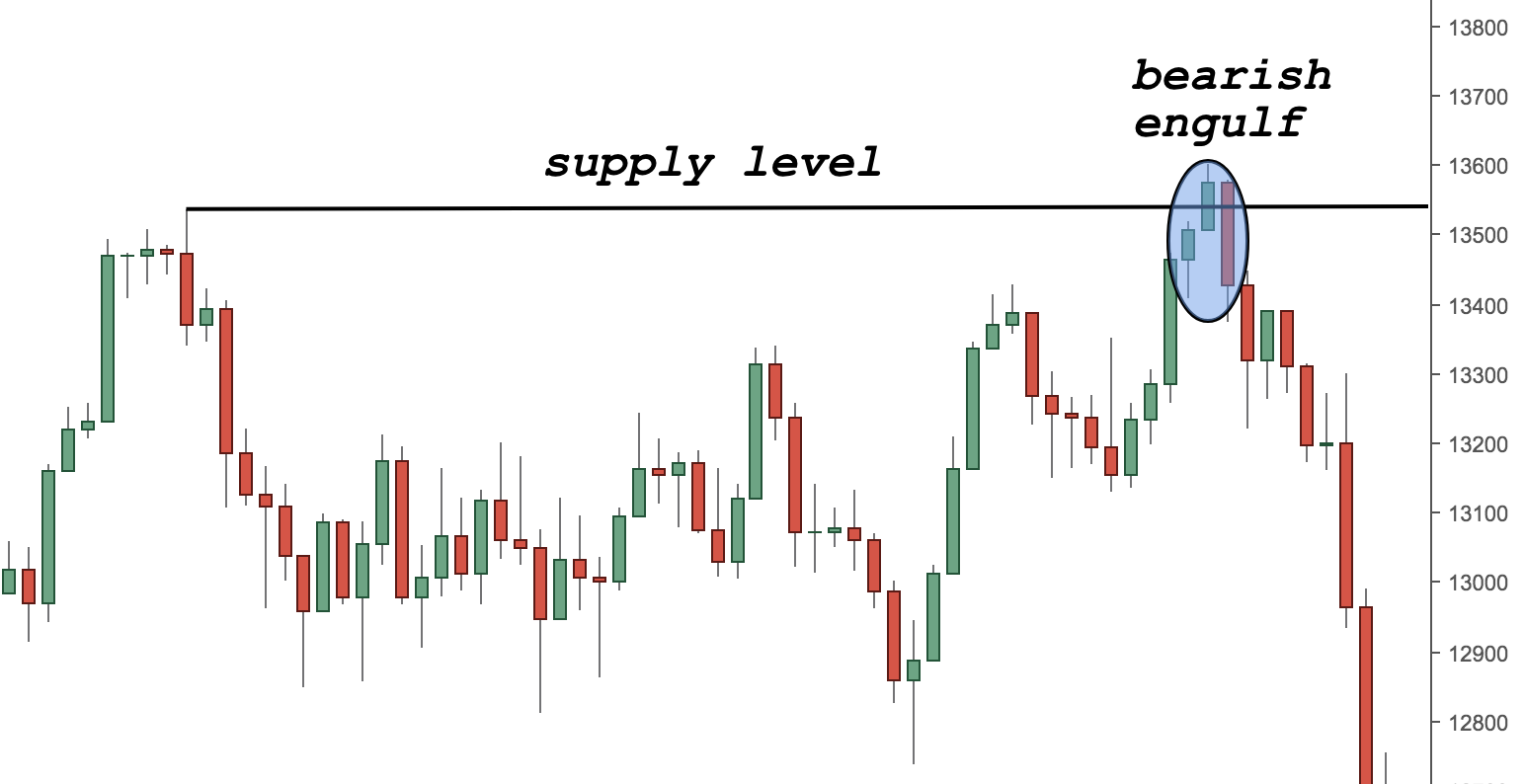

Price Action and Supply Levels

Price activity takes primal role when trading with supply and demand levels.

In fact, toll activeness complements supply and need levels/zones and vice versa. The best fashion to confirm a supply or demand level is by double-checking with price action.

Let's have an example with a well-established supply level where you are looking to enter into a short trade.

What will be the start thing that comes to heed?

Indicator?

Trendline?

Moving average?

I would actually go with price action. Candlesticks are invaluable tools for confirming important supply and demand levels.

Allow'south accept another example.

That'southward the daily nautical chart of the USDCAD. What supply and demand traders volition be looking for is how price reacts to these levels.

Also, traders will be looking for a price action confirmation. The three candlesticks given above are some of the most pop candlesticks that traders would similar to see forming around a supply zone.

It will exist interesting to see how toll volition react to these levels when it reaches that zone. Currently (every bit I am writing this article is 05 April, 2019) price is around 300 pips beneath this zone.

Cost Action and Demand Levels

Very similar to supply levels, need levels are levels at which supply and demand traders are looking for a price activity confirmation.

In club to get to the cost action, y'all will need to have an established level first.

Allow's have a look at another case.

In this screenshot in a higher place you tin can run across the daily chart of EURNZD. Indeed, I wrote about it Hither.

At that place was a demand level and a few months later when price reached this level it formed a bullish engulfing pattern.

This is a very powerful demand level. Toll did literally jump up from this level.

As you can see if y'all did take a merchandise earlier the price activity confirmation, you could take been stopped.

That is why it is always a groovy idea to get a confirmation from price activeness (as the screenshot above shows) earlier jumping into a trade.

Indicators with Supply and Demand Levels

A lot of traders are asking me on a daily footing if I am using any indicators with supply and demand levels and zones.

The curt answer is:

NO.

I know traders who combine indicators with supply and need levels but that is not me.

I find more value of combining cost action and supply and demand levels than anything else.

I am not maxim it won't work, but I personally have tried it and failed.

What on the other side works for me is a combination of cost action and supply and demand levels.

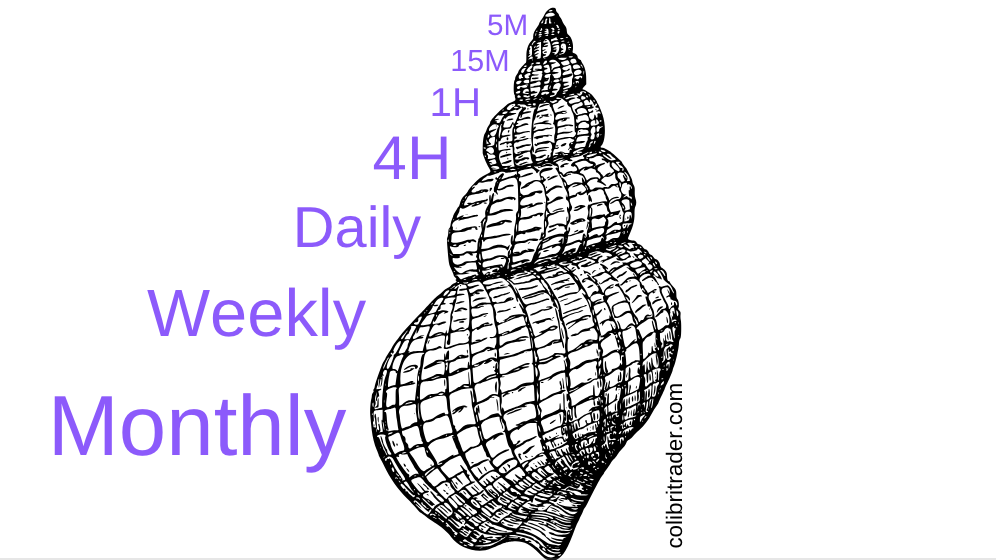

Timeframes and Supply and Demand Levels

Another very important concept when using supply and demand levels are timeframes.

Supply and demand traders are using different timeframes.

In fact, I have met traders using annihilation from 5 minutes to monthly charts.

Although it depends on the approach, I would say that the best timeframes that fit my trading style are 4H, Daily, Weekly and Monthly.

Attention: I do favour Daily and 4H charts in particular. I am using daily for the initial trigger and then 4H for fine-tuning.

Different traders might utilize different timeframes. Some traders might prefer using only 1 timeframe.

It is totally up to your personal preferences, but my experience has taught me that the Daily and 4H charts are the best combination of charts when trading with supply and need levels.

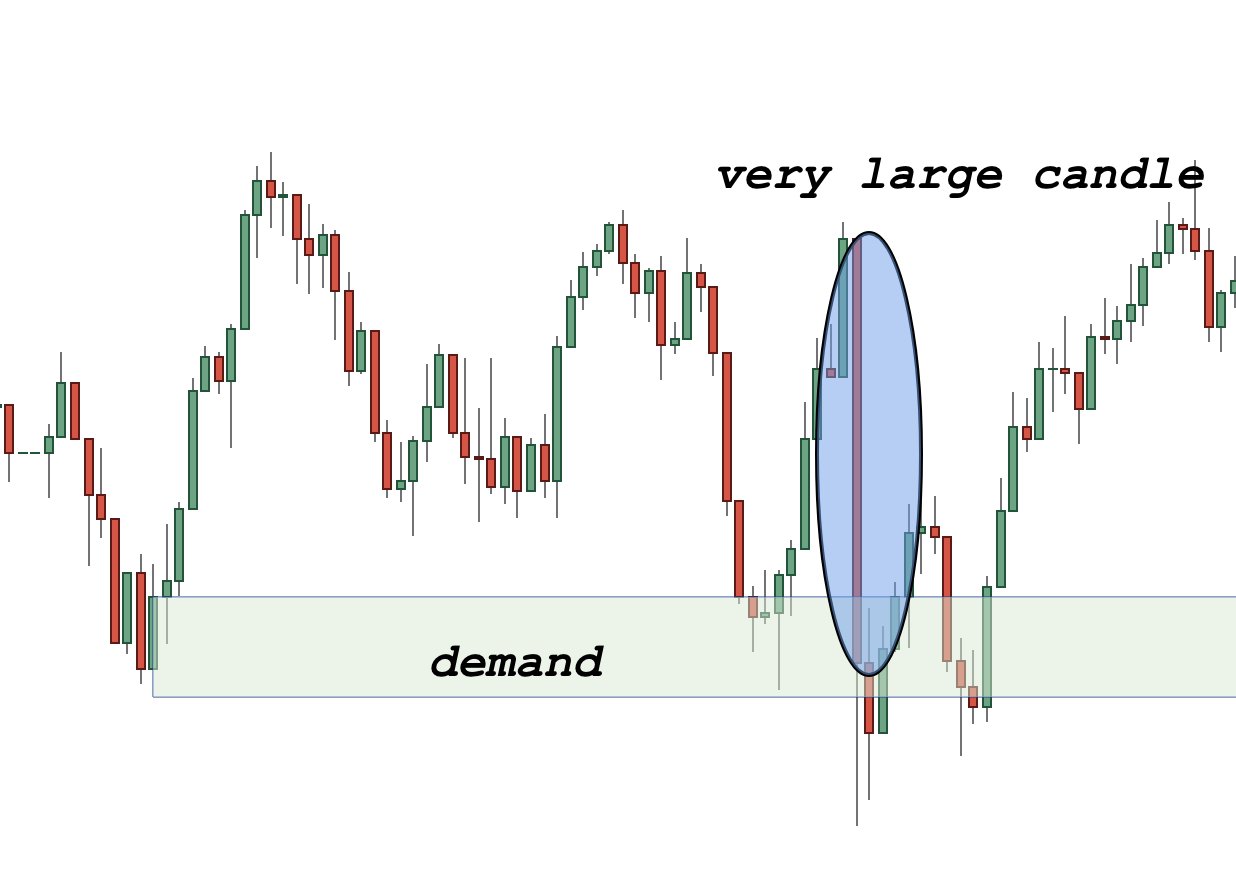

Size of Candles Effectually Supply and Need Levels

Another important element in trading with supply and need is the size of the candles around the supply or demand level.

If the level is very strong, yous volition come across a big bodied candle. That is a skilful indication that a lot of market participants are interested in this level and is a good confirmation past itself.

Here is one instance of a very large red candle in close proximity to a supply zone:

In the paradigm above y'all can meet how rapidly price went down and so formed an inside bar. After which cost hesitated a bit above the demand zone and went back up.

That is a very adept example of a need zone in combination with a toll action signal.

In the example beneath, there is a strong supply level, which is shows larger than usual candles before and subsequently the level was re-tested.

The candles are not equally large as the first image, but that shows you again that trading effectually supply or demand levels is unremarkably surrounded by bigger candles.

Contempo Examples of Supply and Demand Levels

I will utilize this paragraph to share with you some of my recent trading ideas and trades, so you tin can get the full film. I won't be able to reveal my whole trading strategy, since it will take me forever, just will share with you a few screenshots.

The traders who took my supply and demand trading form will certainly know what I am talking virtually.

I will give a few different examples from unlike timeframes.

Examples from the daily timeframe

Here is the offset example:

Above is the daily chart of the EURNZD pair. As yous tin can see, there is a demand zone that acts as a magnet pushing the toll higher. I shared my thoughts on this pair with my followers here.

That was a great setup considering it not only showed a demand zone, but also confirmed it with price activity setup.

Allow's take a wait at another example:

The example higher up is given from the daily chart of XAUUSD.

As you can see, there was a stiff demand surface area that was later confirmed with a pivot bar.

Once over again, trading with supply and demand levels and zones and using price action to execute your trades can be very profitable.

There will be some fake setups as you can wait, but overall a correctly constructed supply and demand trading system should be beneficial to the trader using information technology.

Here is another example:

This is the daily chart of gilt again, simply this fourth dimension is showing a supply level/ zone.

You can see how strong the cost is pushed to the downside once the supply area has been re-tested.

Permit'south change the timeframe and look into a couple of 4H examples:

Examples from the 4-hour timeframe

The first instance that is given is taken from the 4H of gold:

On the manner up, there are plenty of buyers who are pushing the price higher until they accomplish the superlative.

A supply level is formed there and the adjacent fourth dimension toll reaches this level, it chop-chop reverses back.

At that place is a pin bar at the meridian, which confirms the supply zone.

Allow's have a look at another example now:

This is the 4H EURUSD chart. Once the supply zone is formed and price reaches dorsum to it, an inside bar is formed equally shown on the screenshot higher up.

This is a great indication for a continuation of the previously formed downtrend. This was a fantastic example indeed!

Lower timeframes

Although I am non really using the lower timeframes, I know supply and demand traders who are using them successfully.

For the sake of this article, I will give a couple of examples. It is always better if a supply and demand level from the lower timeframes coincides with a supply and demand level or zone from a higher timeframe.

Let's have a look into an example from the 1H nautical chart.

Examples from 1 hour timeframe

Hither is one:

That is the 1-hour chart of the German stock alphabetize DAX. As you can see, the need zone acted once again as a potent repellant for the sellers and pushed the cost higher later on forming an within bar.

This nautical chart is but ane place where demand acted as a support level on a lower timeframe.

Allow's accept a await at another case:

Higher up is the 1-hr chart of rough oil.

As you tin can see there is a supply level/zone, which again acts as a:

- strong magnet for buyers

- nest for curt-sellers

Price went down very sharply afterward it touched the supply level.

Let's have a look at another example:

This is the ane-hour chart of aureate. You can see a strong demand level or more like a small demand zone that has formed betwixt 1302 and 1304.

Once price touched this area of demand, there was an inside bar that formed and shortly after the cost just rocketed to the upside.

Over again, supply and demand levels and zones tin exist used profitably on the lower timeframes, but in my stance they are harder to pinpoint.

In other words, y'all might have more fake signals, since the majority of big players will be watching the higher timeframes.

So I would only consider as a valid trading betoken if a smaller-scale's supply or demand level coincides with a higher timeframe's supply or demand level or a zone.

If y'all are only looking for a smaller timeframe'due south supply and demand levels, they might or might not piece of work. In other words, you might get more false trading signals.

Permit's now wait at another even smaller timeframe just for reference.

Examples from the 15 infinitesimal chart

The example in a higher place is given from the xv minute GBPUSD chart.

Equally you can see, in that location is a supply level (or more probable a zone) in which sellers and buyers are exchanging hands and are turning the direction of the price.

Supply and demand trading is a very powerful technique that if used correctly can atomic number 82 to very profitable results in the long-term.

Let's have a wait at some other example.

Beneath is given the xv-minute chart of the AUDUSD. Look how precisely toll bounces dorsum from the demand level, which it has previously established:

You can see the price quickly pierces through the demand level, forms an within bar so reverses dorsum to the upside.

Although this is a lower timeframe demand level, it coincides with a higher timeframe's need zone.

That is some other reason why it is harder to trade with demand and supply levels on the lower timeframes- y'all should still first by exploring a college timeframe.

In order to visualise this concept better, imagine a giant seashell, where each lower timeframe goes around a larger timeframe and so on advertizing infinitum…

Determination- Supply and Demand Levels and Zones

Instead of a conclusion, I would like to recap the article in a video format.

It might be hard to pinpoint a supply or demand level or zone and it certainly takes fourth dimension and feel to chief this trading method.

But as everything else in life, the more fourth dimension you spend on mastering a subject, the amend you become and the more you run into how many are quitting quickly.

This gives you ameliorate chances at succeeding- the more you lot stick to what works for you, the better your results will be in the future.

Happy Trading,

Colibri Trader

P.S.

Have yous checked my other articles on Supply and Demand Trading or Advanced Supply and Demand Zones

(Visited 22,815 fourth dimension, 2 visit today)

Source: https://www.colibritrader.com/supply-and-demand-levels-and-price-action-trading/

Posted by: maldonadoeareat.blogspot.com

0 Response to "Supply And Demand Levels In Forex"

Post a Comment