What Time Does The Forex Market Open In Melbourne

The foreign substitution market is the most liquid financial market worldwide, with an estimated $5.3 trillion traded daily. Forex is an over-the-counter production, hence in that location is no central physical substitution where the currencies can be traded, different shares that are traded on various stock exchanges.

The forex market is an interbank market, with large banks acting as market makers, offering their ain prices. This means in that location are fewer trading restrictions, such equally when and where you can trade, different stock marketplace hours, where traders are restricted to a weekday timetable with specific hours.

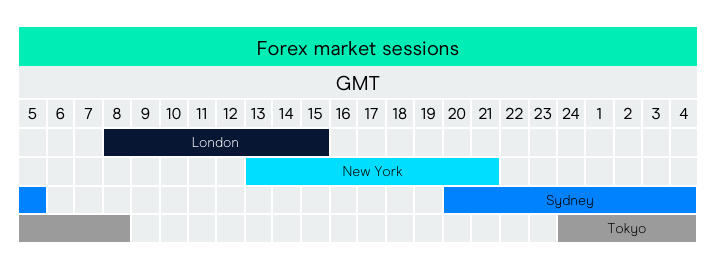

Forex trading hours around the earth

The forex market place is open 24 hours a mean solar day, from Sunday evening until Friday night. This is due to the various international fourth dimension zones which allow you to trade all hours of the mean solar day. There are major trading sessions in these iii locations:

- Tokyo (Asian session)

- London (European session)

- New York (Due north American session)

What time does the forex market open?

During the fall and wintertime months, the Tokyo session opens at 12am and closes at 9am Britain time. It is i of the largest forex trading centres worldwide, with roughly a fifth of all forex transactions occurring during this session. During the Asian session, there'southward probable to be more movement in currency pairs containing the yen, likewise equally Asia Pacific currency pairs, like AUS/USD.

The London forex market opening hours start at 8am UK time and accounts for roughly 35% of all forex transactions (estimated £2.one trillion daily). Due to the large volume of trading during the London session, there are likely to be lower forex spreads as liquidity is higher. However, the London session is also subject to high volatility, often making information technology the best to trade the major currency pairs, which offer reduced spreads due to the high volume of trades. This session closes at 4pm.

The New York session then opens at 1pm and closes at 10pm UK time. In that location is more than liquidity at the start of the New York forex market hours session due to the overlap with the previous London session. Towards the end of the session, at that place is typically minimal movement as the trading twenty-four hours winds downwardly.

The Sydney forex market hours are from 8pm to 5am United kingdom time, completing the 24-60 minutes forex trading loop.

Forex trading sessions

What fourth dimension should you lot trade forex?

Theoretically, an effective time to trade forex is when the market is most active, and then when the greatest volume of trades occur at one time. Such a climate offers high liquidity and tighter spreads. Therefore, the most optimal time to trade is during overlaps between open markets. The heaviest overlap is between the London and New York sessions.

During this fourth dimension, at that place is likewise high volatility, so despite in that location being a tighter spread initially, major economic news announcements could cause the spread to widen. Nevertheless, high volatility can be favourable when trading in the forex market. See our guide on risk management for more on managing volatile markets.

The London session is too the busiest market place of them all, particularly in the eye of the calendar week. Trading on a Fri, however, offers lower volatility with fewer people trading, making liquidity lower. It'south also dependent on what currency pair y'all're trading, for example, trading on JPY would be more than apt during the Asian session. Practice trading on currencies through a spread betting or CFD trading demo account.

What are the nearly volatile currency pairs?

Volatility is dependent on the liquidity of the currency pair and is shown by how much the price moves over a period of time. This impacts the spread, with the price movement being depicted by the number of pips. There will exist pairs which naturally take higher volatility, but numerous factors tin come into play which can cause pairs to go more volatile. Forex market hours can have an effect on the volatility of a forex pair at certain points throughout the mean solar day, either increasing or reducing volatility.

Some of the virtually volatile forex pairs are:

Major currency pairs tend to have lower volatility compared with the exotic pairs, as when there is high liquidity, in that location tends to be lower volatility. Currency pairs from more adult countries tend to have lower volatility equally prices are typically more stable. There is also lower supply and demand for currencies from emerging markets. Read more most the about traded currency pairs around the earth.

What causes volatility in forex?

Major news events, for case, Brexit, tin cause volatility within the forex market and widen spreads. Price fluctuations tin can also be influenced by hikes in interest rates or article price surges.

Trading low liquidity pairs naturally means higher risk, and is recommended for the more than experienced trader who has done their research and has a run a risk management strategy in identify. Find out more about the benefits and risks of trading forex in our guide to elevation tips for FX traders.

Merchandise forex market hours in the Britain

Detect forex trading using spread bets and CFDs on our honor-winning trading platform*, Next Generation. We offering competitive spreads and margin rates on over 330 forex pairs, including major, modest and exotic crosses.

To get started with forex trading, visit our article on forex trading for beginners. For more avant-garde traders, visit our article on how to trade forex for professional person tips and communication on fundamental and technical analysis.

Longer-term forex trading

Longer-term forex trading is possible with the employ of forex forrad contracts. These contracts allow a trader to agree on a future price and appointment of the trade's execution with their banker, with no overnight fees needed to hold the trade. In this circumstance, you would be speculating on whether the base of operations quote would increase or subtract in value confronting the other.

*Awarded No.ane Web-Based Platform, ForexBrokers.com 2020

Disclaimer: CMC Markets is an execution-merely service provider. The material (whether or not it states any opinions) is for full general information purposes only, and does not have into account your personal circumstances or objectives. Zip in this material is (or should be considered to be) financial, investment or other advice on which reliance should exist placed. No opinion given in the textile constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for whatsoever specific person. The material has non been prepared in accord with legal requirements designed to promote the independence of investment research. Although we are non specifically prevented from dealing before providing this textile, we practise not seek to take advantage of the material prior to its broadcasting.

Source: https://www.cmcmarkets.com/en/learn-forex/forex-market-hours

Posted by: maldonadoeareat.blogspot.com

0 Response to "What Time Does The Forex Market Open In Melbourne"

Post a Comment