How To Register A Forex Trading Company In South Africa

Forex and Corona

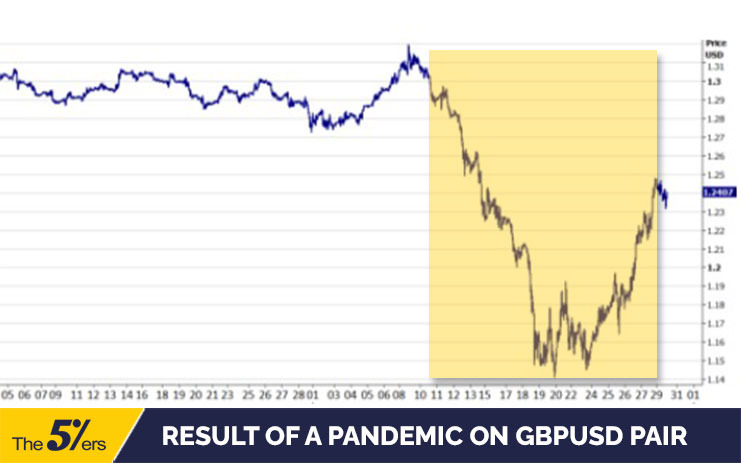

Since the beginning of 2020, the covid pandemic has significantly afflicted the Forex markets which caused the fall of sterling confronting the US dollar past fifteen%. The volatility in this menstruation created a hard valuation environment that hasn't existed for many years.

In that situation, commercial banks and corporations using Forex products tin better understand the impact of increased Forex market volatility on their balance sheets. Also, the banks considered the potential risks to valuation and fiscal reporting. These actions immune the cease-users to maximize the values of their portfolios.

In this article, you can observe a new version of the analysis about the effects of daily contaminations on the fiscal markets, which incorporates the recent third wave.

Relation of Forex and Covid-19

At the start of the Covid crunch, investors have tended to buy the American dollar, specially against emerging market currencies, as a pop trading strategy in the Forex marketplace. As it often does during difficult market conditions, the dollar has served as a safe-haven currency during the crunch.

The following are three primary reasons why the dollar has outperformed:

- In terms of liquidity, it is the most liquid currency globally.

- It is less reliant on external need than nearly adult nations, including Europe.

- Through much of the outbreak, the spread of the virus in the U.s. was relatively less vigorous than in Europe and Asia, especially when measured by the number of people infected.

Financial marketplace atmospheric condition at the start of the pandemic

During the x days following Marchtenth, 2020, the dollar appreciated by about 8% trade-weighted, though it has since given dorsum some gains.

Over the showtime few weeks, EUR/USD has been very volatile, rallying sharply and and then crashing to a about iii-yr depression to a higher place the 1.07 level.

Suppose the interest charge per unit differential between the United States and the Euro Area narrows in the future because of the Federal Reserve's null-charge per unit policy. In that case, investors will no longer have a reason to buy the euro.

Likewise the Us and Canadian dollars, the Norwegian krone, Australian and New Zealand dollars, and sterling have been among the most exposed.

On 18th March 2020, the pound roughshod to its lowest level against the dollar since 1985.

In the pair, unsaid volatility measures have skyrocketed, outpacing levels seen following the Brexit vote in June 2016 during the current crisis – groups that were idea unlikely to be repeated in a generation.

The farthermost selling of the pound occurred by investors unwinding positions that they accumulated following the UK election in December, equally well every bit the college risk premium associated with Brexit and the country'due south big external deficits.

Impact of corona on global Forex Markets

Daily COVID-19 contaminations strongly impact forex exchange market volatility regardless of the degree of development in about countries studied, namely the United states, Europe, Switzerland, Japan, South Africa, Cathay, and Turkey. This is because they all have open up economies and rely heavily on global supply chains (including Europe's proxy).

The country's currency market place became more than sensitive to COVID-19 data, mainly the daily contaminations, equally the pandemic evolved and authorities implemented strict sanitary measures (lockdowns, travel bans, capacity reduction). A surge of contaminations from COVID-19 as well boosted need for gold, U.South. dollars, and Swiss francs as investors sought a haven.

Moreover, in the cases of Russian federation and India, nosotros discover that Daily COVID-19 contaminations have a strong impact.

The very high correlations may exist due to both economies having significant exposures to commodities or exports services, both of which were heavily affected by the COVID-19 pandemic.

It is also likely that the marketplace participants believe that the country is in the early on stages of a prolonged bear bicycle, and they are uncertain nearly the pandemic'south progression and effects on its industrial and service sectors.

Additionally, both countries have taken similar measures on the macroeconomic front to address the socio-economic hardships of the pandemic crisis.

Amidst these policies were reducing key interest rates, reducing macro-prudential cyberbanking rules, and loosening inflow controls.

As a result of the managed float regimes, the cardinal bank s intervened heavily to stabilize the external value of their currencies, which caused large fluctuations in forex volatilities.

Impact on pricing and hedging

Hedging confronting forex volatility with forwarding contracts has been a mainstream strategy for corporate and commercial banks.

The current volatility in the forex markets will affect the value of these contracts, peculiarly since the 2Y GBP/USD forrad rate dropped by around xv% at the start of the pandemic. Even so, the recovery since so has been lackluster, with rates withal trading nearly x% lower than they were at the get-go of the twelvemonth.

Moreover, the volatility of currency markets tin can significantly impact the valuation of Forex derivatives and foreign currency assets and liabilities within a day.

In light of this, stiff diligence and consistency must be practical to the timing of valuation cutting-offs, as well as the functioning of sensitivity analyses to place how explosive growth is likely to impact valuations and operations.

It would too be advisable to reevaluate the handling of derivatives under hedging arrangements.

How will the pandemic affect the currency marketplace in the futurity?

Predicting the global economic recovery after a pandemic is challenging as there are a lot of variables to accept into account.

Every time we see new virus variants or changes in the perception of vaccine efficacy, we witness how quickly things tin modify, making the forex markets even less predictable.

Despite a bleak economic outlook, the UK is optimistic about its time to come wellness since many of society'south almost vulnerable members accept received immunizations, which are considered highly effective in preventing serious illnesses.

After a long flow of lockdown, the British pound will surge as consumers and tourists rush back into the country after the summer and the reopening of businesses.

Currency values may fluctuate as different areas embark on their plans to recover, as market participants remain aware of the risk and the many variables at play.

Forex and Covid Bottom line

COVID-19 contamination connected to significantly impact economies variously (except the United kingdom of great britain and northern ireland and South Korea), with fifty-fifty greater results in the cases. There was a significant influence of COVID-19 vaccinations on all the countries studied, peculiarly those in the Eurozone. Most marketplace participants express optimism regarding the pandemic'southward evolution and impact on the financial market, except Switzerland, Russian federation, and India.

If you want to receive an invitation to our alive webinars, trading ideas, trading strategy, and high-quality forex articles, sign upward for ourNewsletter.

Subscribe to our youTube aqueduct.

Click here to cheque how to get qualified.

Click here to check our funding programs.

Source: https://the5ers.com/forex-and-covid/

Posted by: maldonadoeareat.blogspot.com

0 Response to "How To Register A Forex Trading Company In South Africa"

Post a Comment